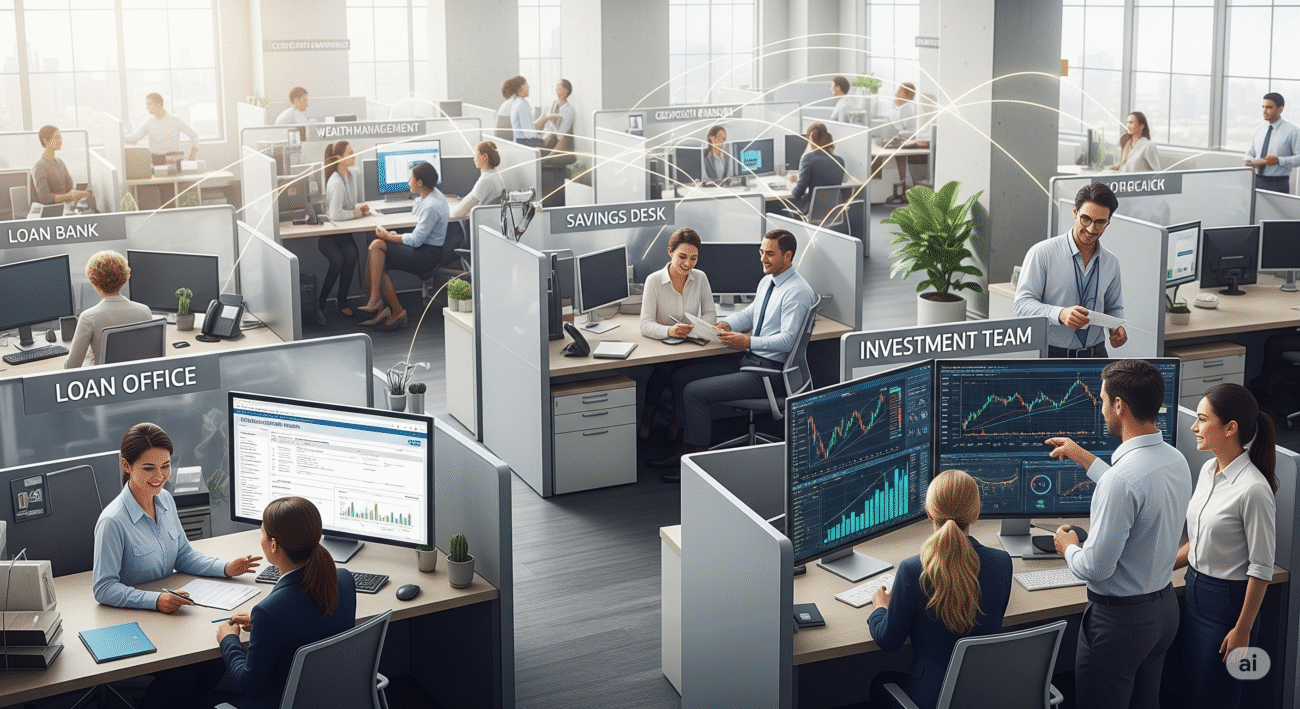

If you are asking what a universal bank is, you are not the only one. Universal Bank is one of the fancier terms used in the business, but it is really simple. A universal bank is the ‘one-stop shop’ of the banking world as it offers every type of financial service under one roof – from savings accounts, loans, investment banking, insurance to asset management.

What is a Universal Bank in A Single Financial Institution?

Universal banking refers to a banking system where a single financial institution provides both commercial banking and investment services. Most banks tend to rely on the deposit and pay loans business, unlike universal banks. Universal Banks are known to offer wealth management services, insurance, mutual funds, and underwriting of corporate debt. They are known to be more customer friendly and are more flexible and thus, highly ubiquitous in the financial ecosystem.

Universal Bank in India

It was the Reserve Bank of India (RBI) that made universal banking a concept that people in India are familiar with in the late 90s. Today, there are many leading financial institutions in India that appear to be operating as universal banks as they offer a full suite of services.

Don’t Miss: What is the Nehru Report?

Which bank qualifies as a universal bank?

HSBC, Citibank, and JP Morgan are universal banks operating in most regions of the world. In India, we have State Bank of India (SBI), ICICI Bank, HDFC Bank, Axis Bank, and Kotak Mahindra Bank as universal banks.

Is SBI a universal bank?

Of course, State Bank of India (SBI) is a universal bank. Apart from the usual savings and loan accounts, SBI provides a wide range of financial services such as insurance, investment banking, and mutual funds through its subsidiary companies.

Universal Bank Uzbekistan

Elsewhere, there is Universal Bank Uzbekistan, which is a commercial banking firm in Uzbekistan that provides retail and corporate banking services. Though it has no direct links with Indian universal banks, it serves as an additional illustration of the universal banking concept and its application across different countries.

Universal Banks in India–UPSC Perspective

For those preparing for UPSC, bear in mind: universal banking is the combination of commercial banking with other financial services, thus providing a boost in efficiency and profitability. In India, the transition to universal banking has been advantageous in enabling banks to alter their income sources and depend less on interests to sustain the banks.

Universal Banks List in India

Here’s India’s Top 10 List of Universal Banks

1. State Bank of India (SBI)

2. HDFC Bank

3. ICICI Bank

4. Axis Bank

5. Kotak Mahindra Bank

6. Bank of Baroda

7. Punjab National Bank (PNB)

8. Union Bank of India

9. Canara Bank

10. IDBI

Also read: Service Allocation CSE 2024: A Complete Guide

How many universal banks in India are there?

Based on the practices adopted by many large public and private sector banks in India, there are no nominal public and private sector universal banks now as most are operating as universal banks.

Who is the No. 1 bank of India?

State Bank of India (SBI) is the No 1 bank in India and has the most assets, reach and customer base.

Universal Bank Careers

Retail banking, corporate finance, and even investment advisory and risk management are all available to those working in universal banks. The range of possibilities is increased due to the additional service lines offered by these banks as compared to more traditional banks.